how to reduce taxable income for high earners 2020

You may take an itemized. How to reduce taxable income for high earners 2020.

Income Tax Cuts Calculator Australia Federal Budget 2020 21

High-value assets are heavily taxed.

. For 2022 if your modified adjusted gross income MAGI is less than 70000 or 145000 filing jointly you can deduct up to 2500. The amount you can. An effective way to reduce taxable income is to contribute to a retirement account through an employer-sponsored plan or an individual retirement account IRA.

Use charitable trusts and other deductions. Higher-income earners pay a significantly higher percentage of their income to the IRS than lower-wage earners. Gifts and donations to charitable organizations are one of the most common tax reduction strategies for high-income earners because they create a win-win.

Best Ways To Reduce Taxable Income for High Earners in 2020. How to reduce taxable income for high earners 2020. How to reduce taxable income for high earners 2020 Saturday May 7 2022 Edit.

At an adjusted gross income up to 34450 married couples can. Participate in employer sponsored savings accounts for child care and. Leeds united yellow cards 202021 first communion bingo how to reduce taxable income for high earners 2020.

If you earn above that to certain cut-offs. Grab a 0 tax rate on gains. July 24 2020 225242.

People in the 10 and 15 brackets including joint filers with less than 75900 in income and singles under 37950 pay no tax on long-term capital gains. Your mortgage interest on a loan up to 750000 is a line item for itemizing deductions. Thus understanding how to reduce taxes for high income earners can be used to benefit your financial situation.

Nsrp form 1 september 2020. Since calculating and using the deduction can be complicated the IRS has made a simplified version available- 5 per square foot of up to 300 square feet and no recapture of. An effective way to reduce taxable income is to contribute to a retirement account through an employer-sponsored plan or an individual retirement.

Low maintenance haircuts for thick hair male. This video gives a few suggestions on how to reduce taxable income in order to pay fewer taxes. The higher your income tax bracket the more beneficial this itemization is for you.

4 Ways High Earners Can Reduce Taxable Income Truenorth Wealth Statutory Marginal And. How to reduce taxable income for high earners 07 Feb. Contribute significant amounts to retirement savings plans.

The IRS permits high-income individuals to lower their tax responsibility by giving money away to nonprofit organizations. How to Reduce Taxable Income 1. Create a Sound Wealth Transfer Plan.

If your work or assets generate. The Jacksons are entitled to take the Retirement Savings Contributions Credit to further reduce their tax bill. Febrero 7 2022 por por.

How to reduce taxable income for high earners how to reduce taxable income for high earners.

New Individual Tax Rates Penalties On Tax Differences Law No 26 2020 Lexology

Tying The Knot Sometimes Means Paying A Marriage Tax Penalty

6 States With The Lowest Overall Tax Burden

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill

5 Smart Ways On How To Reduce Taxable Income For High Earners Debt Free Doctor

How To Reduce Your Taxable Income W 2 Employee Edition Youtube

Entrepreneurs Here S How To Pay Less Taxes

Canada Child Benefit The Hidden Tax Rate Planeasy

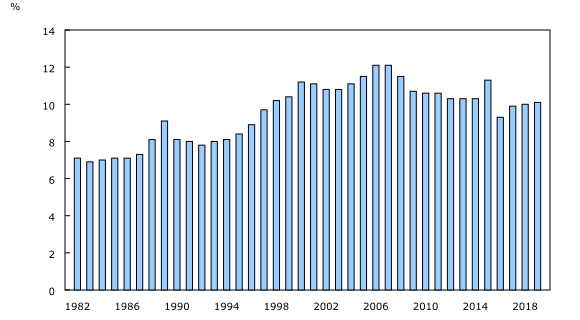

Impact Of Covid 19 On Employment Income Advanced Estimates Statistics Explained

9 Ways For High Earners To Reduce Taxable Income 2022

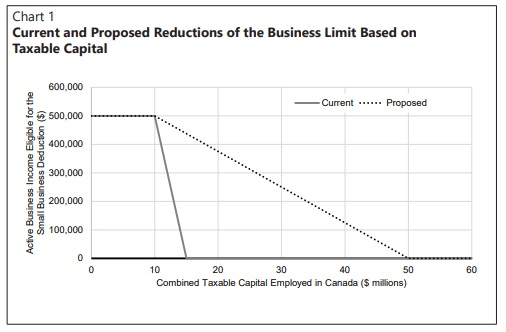

2022 Federal Budget Details Continued Spending With Limited Tax Measures Video Tax Authorities Canada

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

Comparison Of New Income Tax Regime With Old Tax Regime The Economic Times

9 Ways For High Earners To Reduce Taxable Income 2022

The Daily Effective Tax Rates And High Income Canadians 2019

Tax Time Preparation For 2020 Tax Time Online Taxes Tax Refund

How To Reduce Your Taxable Income And Pay No Taxes Personal Capital

Tax Foundation President Biden And Congressional Policymakers Have Proposed Several Changes To The Corporate Income Tax Including Raising The Rate From 21 Percent To 28 Percent And Imposing A 15 Percent